Tax (known in different regions as VAT, GST, or consumption tax) may be included in your WordPress.com purchases. This guide will answer common questions about your WordPress.com subscriptions and these consumption-based taxes.

In this guide

Our services are subject to consumption-based taxes in many jurisdictions. Depending on your location, this can appear as Value Added Tax (VAT), Goods & Services Tax (GST), or Consumption Tax (CT).

When making a purchase on WordPress.com, you are charged the relevant tax based on your billing address.

The tax will be displayed as an independent line item on the checkout screen. You can also find the tax charge listed on your billing receipt.

Tax-registered businesses may be exempt from paying consumption-based taxes. As a tax-registered business, you can enter a valid VAT or GST ID to avoid being charged tax on your purchases and renewals. You will be charged tax if you have not entered tax details into our system.

EU-based users can check the VAT Information Exchange System (VIES) FAQ, which answers common questions. Users based in other locations should check their locale’s specific consumption-tax rules. As an Ireland-based company, we must charge VAT on all transactions in Ireland, including those to VAT-registered businesses.

To avoid being charged tax on your next purchase or renewal, add your eligible tax details using the steps described in the section below.

Some customers or organizations qualify to make sales tax-exempt purchases. Tax exemptions are granted at the state or country level. Please contact your tax advisor or your state or local taxing authority to determine if your organization qualifies for sales tax exemption.

If you have a valid tax exemption that you wish to apply to your WordPress.com purchases, you can contact us to submit your documentation. Your proof of tax exemption should include the following:

- Name of your exempt organization.

- Your tax exemption documentation.

- Any additional information required by your government.

You can add your VAT, GST, or consumption-based business tax ID details to your account to display your tax details in your receipts and ensure you only pay the appropriate tax. The tax ID details apply to all sites on your account.

When making a purchase, you will enter your billing location. If your country is subject to a consumption-based tax, you can enter your business tax ID details by ticking the box labeled “Add VAT/GST details“:

You can add tax details at any time in your WordPress.com account by following these steps:

- Click on your profile at https://wordpress.com/me.

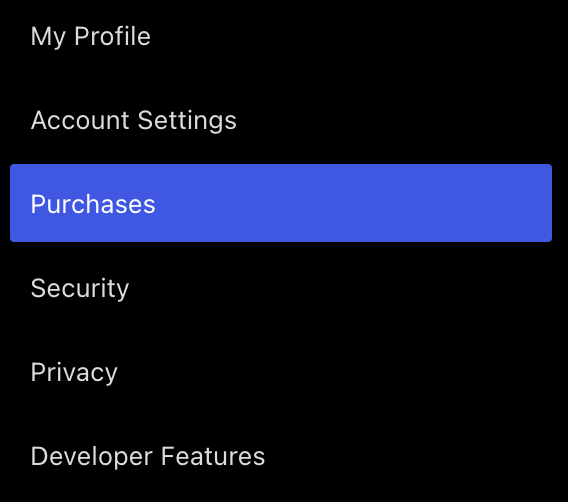

- On the left side, select the Purchases menu option:

- At the top of the screen, select the “Billing History” tab:

- Scroll down to the bottom of the screen, below your list of transactions.

- Click the “Add tax details” link, which will be labeled “Add VAT details”, “Add GST details”, or the name of the consumption tax in your region.

- Select your country and type your tax ID number, name, and address.

- Click the “Validate and save” button.

Once you have entered the tax details for your account, you can click “View receipt” (or “Email receipt”) in your Billing History for any purchase. The tax details will be included in all past and future receipts.

After adding your tax details, you will need to contact support to change the existing tax details in your account.

The tax ID details you add apply to all sites in your account. If you have separate businesses that use individual VAT, GST, or consumption-based business tax ID details, you will want to set up a separate account for that business.

Contact our Happiness Engineers for help if you:

- Need to update your existing business Tax ID details.

- Have been charged VAT as a VAT-registered business subject to reverse charges.

- Have any questions not answered in this guide.

Include your VAT number and country code when you contact us.